You’ve worked hard, pouring your heart and soul into your home-based business. Now, it’s time to reap the rewards and ensure you’re maximizing your tax benefits. But with hundreds of potential deductions, navigating the complex world of home office tax deductions can feel like a daunting task. This guide will equip you with the knowledge you need to understand the ins and outs of claiming your rightful deductions, saving you valuable time and money.

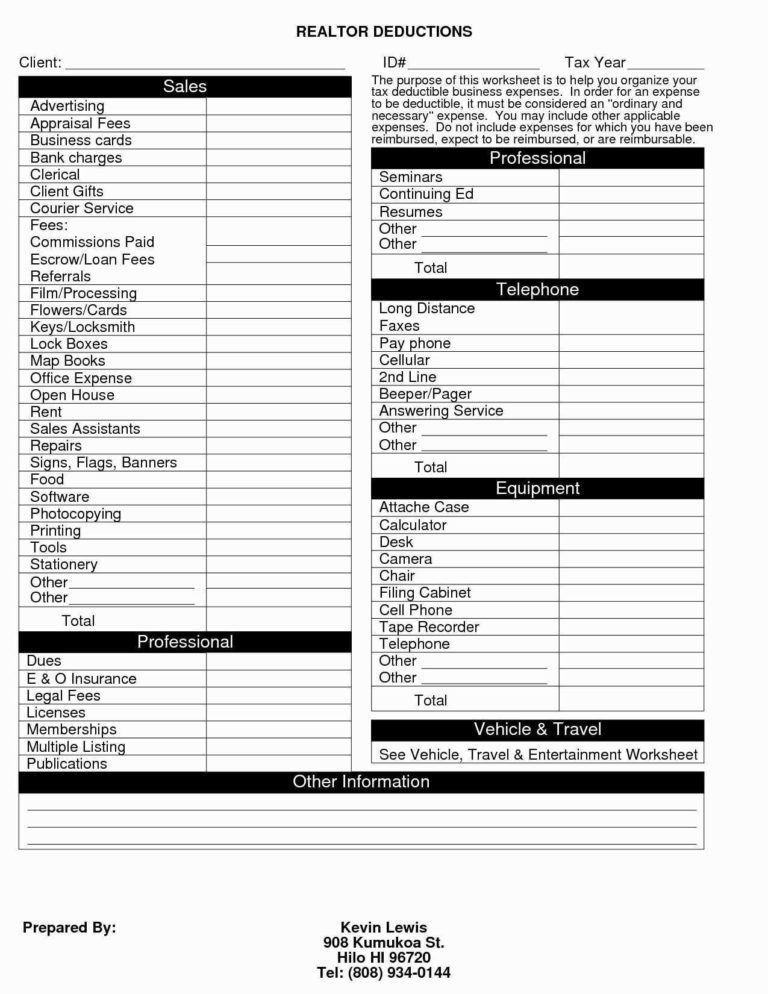

Image: www.slideshare.net

Don’t underestimate the power of these deductions. Claiming every eligible expense can significantly lower your tax burden, allowing you to reinvest more back into your business and fuel its growth. Whether you’re a seasoned entrepreneur or just starting, this guide will be your go-to resource for maximizing your home-based business tax advantages.

Demystifying the World of Home Office Deductions

The IRS offers a variety of deductions specifically for home-based businesses, allowing you to claim a portion of your home expenses as business expenses. But before you dive into the nitty-gritty, it’s essential to grasp the fundamental concepts of home office tax deductions.

The Importance of the “Home Office”

First and foremost, to qualify for home office deductions, you must meet a specific IRS criteria: the space must be used exclusively and regularly for your business. This means it must be your primary place of business, not just a spot you occasionally use for work.

Understanding the Two Methods

Then, comes the question of how to calculate your deduction. Fortunately, the IRS provides two methods:

- **The Actual Expense Method:** This method allows you to deduct the actual expenses directly related to your home office, such as rent, mortgage interest, insurance, utilities, and repairs. However, you can only deduct the portion of these expenses that correspond to the percentage of your home used for business.

- **The Simplified Method:** A simplified option for those who don’t want to track every expense. Under this method, you can deduct $5 per square foot of your home office space, up to a maximum of 300 square feet.

The ideal method depends on your individual circumstances and preferences. But rest assured, this guide will walk you through each method in detail, empowering you to make the right choice for your situation.

Image: trackingryte.weebly.com

Unveiling the 475+ Tax Deductions: A Treasure Trove for Your Home-Based Business

Now that we’ve laid the groundwork, let’s delve into the heart of this guide – the 475+ tax deductions specifically designed for home-based businesses. These are your secret weapons to minimize your tax liability and unleash the full potential of your entrepreneurial journey.

Direct Business Expenses: The Essentials

Start by focusing on the direct expenses incurred in running your business. These are the bread-and-butter deductions that every home-based entrepreneur should claim:

- Home Office Expenses: As mentioned earlier, you can claim a portion of your home expenses, including rent, mortgage interest, insurance, utilities, and repairs. The percentage you can deduct is determined by the square footage of your dedicated workspace.

- Office Supplies: These include everyday essentials like paper, pens, folders, toner cartridges, and other office supplies specifically used for your business. Don’t forget to include any subscription services, such as online storage or productivity software.

- Software and Licenses: From accounting software to email marketing platforms, any software or licensing fees related to your business are deductible.

- Advertising and Marketing: Promote your business with effective advertising and marketing campaigns. This includes the cost of online ads, social media marketing, flyers, and even website development and hosting.

- Professional Services: Engaging with professionals like accountants, lawyers, and consultants is essential for any business. These expenses can be deducted as a business expense.

- Travel Expenses: If your job requires you to travel for business, you can deduct expenses like airfare, hotel stays, and meals.

- Insurance Premiums: Business insurance is crucial for protecting your assets and mitigating risks. Premiums for liability insurance, property insurance, and other business-related insurance are deductible.

- Vehicle Expenses: If you use your personal vehicle for business, you can deduct expenses like mileage, repairs, and insurance. You can use the standard mileage rate or the actual expense method.

Indirect Business Expenses: The Often Overlooked

Aside from direct business expenses, keep in mind these often overlooked indirect costs that can also be deducted:

- Depreciation: This deduction gradually allows you to write off the cost of tangible assets like computers, furniture, and equipment over their useful life.

- Homeowner’s Association Fees: If your business operates out of a homeowners association, you can deduct a portion of the fees allocated to your business space.

- Interest Expense: Interest payments on business loans are also deductible. This can significantly reduce your overall tax burden.

- Property Taxes: Similar to homeowner’s association fees, you can deduct a portion of property taxes associated with your home office.

- Utilities: While utilities are generally considered a home expense, you can deduct the portion allocated to your business space.

The “Home” Deduction: A Comprehensive Guide

Now, let’s take a deeper dive into the deductions related specifically to your home office.

The Actual Expenses Method: A Detailed Approach

If you opt for the actual expenses method, you must carefully track and document every expense related to your business. Here’s how it works:

- Percentage Calculation: Determine the percentage of your home that is used exclusively for business. For example, if your dedicated workspace is 100 square feet and your total home size is 1,000 square feet, your business space represents 10% of your home.

- Allocate Expenses: Multiply your total home expenses by this percentage to determine the deductible portion.

- Recordkeeping: Maintain detailed records of all expenses, including receipts and invoices. This includes all expenses, including mortgage interest, insurance premiums, property taxes, and utilities.

The Simplified Method: Simplicity for Ease of Calculation

The simplified method offers a streamlined approach to claiming deductions. Here’s what you need to know:

- Maximum Space: You’re allowed to deduct $5 per square foot of your home office space, with a maximum of 300 square feet. This means your maximum deduction would be $1,500.

- No Recordkeeping: The convenient part about this method is you don’t need to meticulously track all your home expenses. You simply multiply your dedicated workspace size by $5 and claim that amount as a deduction.

- Choosing the Right Method: While the simplified method might seem easier, it can sometimes lead to a smaller deduction compared to the actual expenses method. It’s essential to thoroughly analyze your expenses to determine which method yields a greater benefit for your specific situation.

Beyond the Basics: Maximizing Your Deductions

Beyond the standard deductions, there are unique opportunities to optimize your tax savings. Here are some bonus tips:

- Deduct Home Improvements: If you’ve made home improvements specifically benefiting your business space, you can deduct a portion of the cost. For example, if you’ve added a bathroom or installed a new heating system in your office area, you can deduct the portion attributable to those improvements.

- Home Office Depreciation: You can deduct the depreciation of your home office over time, further reducing your tax liability. However, you must meet certain eligibility criteria for this deduction. It’s highly advisable to consult with a tax professional for guidance on this specific deduction.

- Keep Detailed Records: Maintain accurate records of all your business expenses, both direct and indirect. This includes receipts, invoices, bank statements, and even mileage logs for vehicle usage. Detailed recordkeeping is crucial for justifying your deductions and avoiding IRS scrutiny.

- Consult with a Tax Professional: For complex situations or if you have doubts về các quy định cụ thể, always seek professional guidance. A certified tax professional can help you navigate the intricacies of tax law, recommend the most advantageous deduction strategies, and ensure you’re maximizing your tax savings.

475 Tax Deductions For Home-Based Business Pdf

Download the 475 Tax Deductions for Home-Based Businesses PDF

Ready to take control of your taxes and unleash the full potential of your home-based business? Download the comprehensive PDF Guide – “475+ Tax Deductions for Home-Based Businesses.” This in-depth guide provides detailed explanations, examples, and checklists to ensure you claim every eligible deduction. Equipped with this valuable resource, you’ll be able to confidently navigate the complex world of home office deductions and secure your rightful tax savings.

Don’t miss out on the opportunity to maximize your tax benefits. Download your copy of the “475+ Tax Deductions for Home-Based Businesses” PDF today – your journey to tax optimization starts now!