Have you ever been faced with a big decision, unsure whether the potential benefits outweigh the costs? Whether it’s choosing a new car, investing in a business venture, or even deciding on a new career path, there’s a powerful tool that can help you make the best choice: the benefit-cost ratio. This ratio is like a financial compass, guiding you towards decisions that maximize your gains while minimizing your losses.

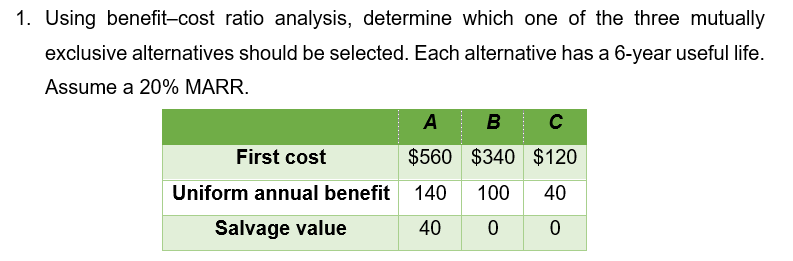

Image: www.chegg.com

In my own life, I recently used the benefit-cost ratio to decide whether to invest in a new piece of equipment for my freelance writing business. After crunching the numbers, I realized that the potential increase in productivity and efficiency was far greater than the initial investment. The benefit-cost ratio clearly pointed me towards the “yes,” and I haven’t regretted the decision since.

Understanding the Benefit-Cost Ratio

The benefit-cost ratio is a simple yet effective way to assess the financial viability of any project, investment, or decision. It’s a powerful tool used by businesses, governments, and individuals alike to make informed choices and allocate resources strategically. Essentially, it helps you compare the potential benefits of an action to the associated costs.

The benefit-cost ratio is calculated by dividing the expected benefits of a project or decision by the expected costs. A ratio greater than 1 indicates that the benefits outweigh the costs, making the project financially attractive. Conversely, a ratio less than 1 suggests that the costs outweigh the benefits, making the project less appealing.

The Formula:

The benefit-cost ratio formula is:

Benefit-Cost Ratio = Total Expected Benefits / Total Expected Costs

Here’s how it breaks down in practical terms:

Example 1: Investing in a New Laptop

Let’s imagine you’re thinking about buying a new laptop for your work. You’ve found a model that’s powerful enough to handle your needs, and it costs $1,500. You expect this laptop to increase your productivity, allowing you to complete more projects, which you estimate will result in an additional $2,000 in income over the next year.

To calculate the benefit-cost ratio, you would divide the expected benefits ($2,000) by the cost of the laptop ($1,500):

Benefit-Cost Ratio = $2,000 / $1,500 = 1.33

This means that for every dollar invested in the new laptop, you expect to receive $1.33 in return, making it a financially attractive investment.

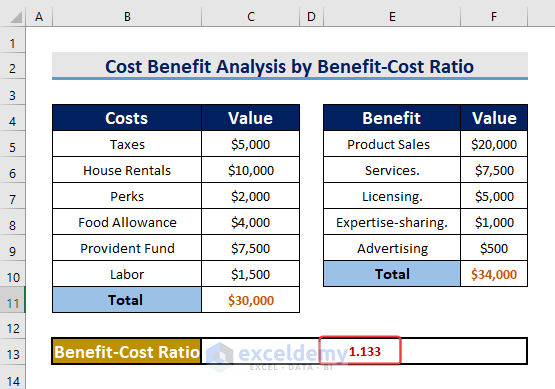

Image: www.exceldemy.com

Example 2: Solar Panel Installation

Another common application of the benefit-cost ratio is in the decision to invest in renewable energy sources. Let’s say you’re considering installing solar panels on your roof. The installation cost is $10,000, but you expect to save $1,500 per year on your electricity bill.

To assess the financial viability, you’ll need to calculate the benefit-cost ratio over a specific time frame. Let’s assume you want to analyze this over a 10-year period. Your total expected benefits would be $1,500/year x 10 years = $15,000. Your benefit-cost ratio would then be:

Benefit-Cost Ratio = $15,000 / $10,000 = 1.5

This indicates that you can expect to receive $1.50 in benefits for every dollar invested in the solar panels, making it a financially sound decision.

Key considerations when using the benefit-cost ratio:

While the benefit-cost ratio is a valuable tool for making informed decisions, it’s important to remember that it’s not perfect. Here are some key considerations:

- Qualitative factors: The benefit-cost ratio primarily focuses on quantifiable benefits and costs. It doesn’t account for qualitative factors like environmental impact or social benefits, which might be significant.

- Uncertainty and risk: The benefit-cost ratio relies on projected benefits and costs, which may not always be accurate. It’s important to consider the potential for uncertainty and risks, and adjust your calculations accordingly.

- Time value of money: The value of money changes over time. The benefit-cost ratio may not adequately account for the time value of money, particularly for projects with longer timelines.

Making the Most of the Benefit-Cost Ratio

To use the benefit-cost ratio effectively, it’s crucial to make sure your calculations are accurate and comprehensive. This means considering all potential benefits and costs, even if they are difficult to quantify. When in doubt, it’s always best to err on the side of caution and factor in a margin of safety.

Here are some tips for using the benefit-cost ratio to make informed decisions:

- Clearly define your objectives: Before calculating the benefit-cost ratio, clearly define what you hope to achieve with the project or decision. This will help you identify the relevant benefits and costs.

- Be realistic about your estimates: Use conservative estimates for your benefits and costs, particularly when dealing with uncertainty. Don’t be overly optimistic about potential gains or underestimate the associated expenses.

- Consider the time value of money: If your project has a long timeline, factor in the time value of money to ensure that you’re accurately comparing benefits and costs over time.

- Don’t ignore qualitative factors: While the benefit-cost ratio is primarily a quantitative tool, don’t ignore the importance of qualitative factors. Consider the environmental, social, and ethical implications of your decision.

Frequently Asked Questions

What are some common applications of the benefit-cost ratio?

The benefit-cost ratio is used in various fields, including:

- Business: Evaluating investment projects, product launches, and marketing campaigns.

- Government: Analyzing the economic impact of infrastructure projects, public policies, and social programs.

- Personal finance: Making decisions about investments, education expenses, and major purchases.

What are some limitations of the benefit-cost ratio?

As mentioned earlier, the benefit-cost ratio is not a perfect tool. It has some inherent limitations, such as:

- Difficult to quantify all benefits and costs: Not all benefits and costs can be easily measured financially, making it difficult to account for everything.

- Uncertainty in estimations: The ratio relies on estimations, which may not always be accurate, leading to potential biases.

- Focus on financial aspects: It doesn’t consider all aspects of a decision, primarily focusing on financial benefits and costs.

Is the benefit-cost ratio always the determining factor?

While the benefit-cost ratio can be a helpful tool, it shouldn’t be the sole factor in making decisions. It’s essential to consider all relevant aspects, including qualitative factors, risk, and your own values and preferences.

Benefit-Cost Ratio Example Problems With Solutions

Conclusion

The benefit-cost ratio is a powerful tool for making informed decisions when evaluating the financial viability of projects, investments, and opportunities. By understanding the concept and applying it effectively, you can gain a clearer perspective on the potential benefits and costs associated with your choices.

Are you interested in learning more about the benefit-cost ratio and how it can be applied to your personal and professional life? Share your thoughts and experiences in the comments below!