Imagine this: you’re applying for a loan at your local bank. The loan officer asks for a confirmation of your employment, a routine formality to verify your income and stability. You’re confident, but you haven’t thought about this document before. What exactly is a confirmation of employment letter, and how do you obtain one? This seemingly simple request can be a bit confusing, especially if you’ve never needed it before. Let’s dive into the details and demystify the process of obtaining a confirmation of employment letter for your bank.

Image: www.pdffiller.com

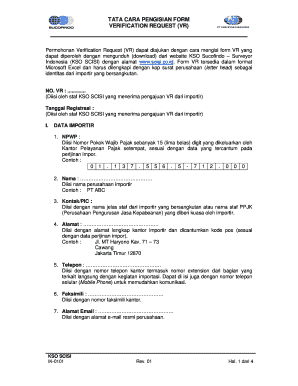

A confirmation of employment letter is a powerful document that carries significant weight in various situations, especially when it comes to financial transactions. It’s not just a “piece of paper”; it’s a crucial piece of evidence that verifies your employment status, which, in turn, builds trust and confidence with lenders, landlords, and other stakeholders.

Understanding the Importance of a Confirmation of Employment Letter

A confirmation of employment letter acts as a formal document that certifies your employment status with a specific company. It’s essentially a written guarantee issued by your employer, confirming that you are indeed employed and providing details about your position, salary, and employment dates. This letter serves as a credible source of information for various purposes, including:

Key Uses of a Confirmation of Employment Letter

- Loan Applications: Banks and other financial institutions often require a confirmation of employment letter to assess your financial standing and ability to repay a loan.

- Mortgage Applications: Similar to loan applications, mortgage lenders require this letter to verify your income and stability before approving your mortgage.

- Rental Applications: Landlords may demand a confirmation of employment letter to ensure that you can afford the rent and have a stable income source.

- Credit Applications: Some credit card companies and other credit providers may also ask for a confirmation of employment to assess your creditworthiness.

- Immigration Applications: When applying for visas or other immigration-related documents, you might need a confirmation of employment letter to prove your ties to your home country.

- Visa Applications: For certain types of visas, such as work visas, a confirmation of employment letter is essential to demonstrate your employment status and eligibility.

How to Obtain a Confirmation of Employment Letter

The process of obtaining a confirmation of employment letter is generally straightforward. However, it’s best to consult your company’s HR policies or employee handbook for specific instructions. Here’s a general overview of the steps involved:

![40+ Employment Verification Letter Samples [FREE Templates]](https://www.wordtemplatesonline.net/wp-content/uploads/employment-verification-letter-for-bank-account.jpg)

Image: www.wordtemplatesonline.net

Step-by-Step Guide

- Contact Your HR Department: The first step is to reach out to your company’s Human Resources department or your immediate supervisor. Let them know that you need a confirmation of employment letter for a specific purpose (e.g., loan application).

- Provide Specific Details: Be prepared to provide the necessary details, including the name of the institution or individual requesting the letter, the purpose of the letter, and any specific information they might require.

- Review and Approve: The HR department or your supervisor will review and approve the confirmation letter. Depending on your company’s policy, your signature may be required as well.

- Deliver: Once the letter is finalized, it can be delivered through various channels like email, regular mail, or in person. Ensure the letter is delivered to the correct recipient.

Tips for a Successful Confirmation Letter

While the process of obtaining a confirmation of employment letter is simple, there are some key aspects to keep in mind to ensure a smooth and successful experience:

Important Considerations:

- Accuracy: The confirmation letter should be accurate and reflect your current employment details. It should include your full name, job title, start date, and current salary. Any errors can lead to delays or complications.

- Clarity: The language used in the confirmation letter should be clear and concise, avoiding any ambiguities. It should clearly state that you are employed with the company and provide the necessary details.

- Professionalism: The letter should be professionally written and formatted. It should be free of grammatical errors and typos.

- Company Letterhead: Ideally, the confirmation of employment letter should be written on the company’s official letterhead, which helps add credibility to the document.

- Security: For sensitive purposes like loan applications, consider scanning and digitally signing the letter to enhance security and prevent tampering.

Frequently Asked Questions

Here are some common questions and answers regarding confirmation of employment letters:

Q&A Section:

Q: What if my company doesn’t provide confirmation of employment letters?

A: If your employer doesn’t offer a standard confirmation letter, you can request a letter on company letterhead stating that you’re employed. Include details like your job title and date of employment.

Q: How long is a confirmation of employment letter valid for?

A: It typically depends on the institution requesting the letter. It’s best to review their specific requirements or ask your employer for recommendations.

Q: Can I write my own confirmation of employment letter?

A: Although it’s possible, it’s not recommended. It’s best to have the letter prepared by your employer on company letterhead for authenticity and recognition.

Confirmation Of Employment Letter For Bank

Conclusion

Obtaining a confirmation of employment letter for your bank or other institutions is an essential step in proving your financial stability and credibility. Understanding the process and ensuring a clear, accurate, and professional document can contribute to a smooth and successful outcome, whether it’s securing a loan, mortgage, or rental agreement.

Are you now feeling more confident about obtaining a confirmation of employment letter for your banking needs? Share your thoughts and any questions you may have in the comments section below.