Imagine a company’s financial records as a vast, intricate tapestry woven from countless transactions. Each thread represents an individual transaction, contributing to the bigger picture of the company’s financial health. But how do we know when the tapestry is complete? How do we make sure that all the threads are accounted for and that the final picture is accurate? That’s where closing entries come in. These entries are the final steps in the accounting cycle, ensuring the books are balanced and ready for a new period.

Image: www.bookstime.com

Closing entries are a critical part of the accounting process, serving as a bridge between one accounting period and the next. They essentially “close” the temporary accounts (income and expense accounts) by transferring their balances to the permanent accounts (equity accounts). This process ensures that the balance sheet accurately reflects the company’s financial position at the end of the accounting period, while the income statement reflects the company’s profitability over that period. By understanding the mechanics of closing entries, you can gain better insights into the financial performance and health of a business.

The Importance of Closing Entries

1. Ensures Accurate Financial Statements

The primary objective of closing entries is to ensure that financial statements, such as the income statement and balance sheet, present an accurate picture of the company’s financial performance and position. This is achieved by transferring the balances of temporary accounts to permanent accounts, effectively zeroing out the temporary accounts for the next accounting period.

2. Reflects Profitability & Financial Position

Closing entries allow businesses to analyze their profitability and financial position effectively. By transferring the balances of revenue and expense accounts to the retained earnings account, the income statement reflects the company’s net income or loss for the period. This, in turn, helps determine the company’s financial health and overall performance.

Image: www.studypool.com

3. Prepares for the Next Period

Closing entries are a crucial step in preparing for a new accounting period. By zeroing out the temporary accounts, the accounting system is ready for fresh data related to the next period’s transactions. This ensures an accurate and efficient recordkeeping process for the upcoming period.

Understanding the Mechanics of Closing Entries

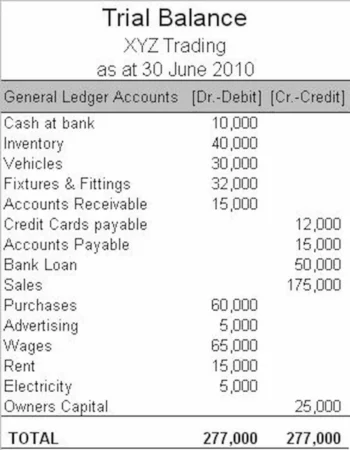

1. The Trial Balance

Before preparing closing entries, an adjusted trial balance is prepared. This trial balance includes all the accounts with their updated balances after any adjustments made during the accounting period. The adjusted trial balance provides the base for creating closing entries.

2. Closing Temporary Accounts

The heart of closing entries involves transferring the balances of temporary accounts, namely revenue, expense, and dividend accounts, to the permanent account, Retained Earnings. Here’s how it works:

- Revenue Accounts: Revenue accounts are credited during the accounting period to record the inflow of funds from sales or services. When closing entries are made, these accounts are debited to transfer the balance to the Retained Earnings account, which is credited.

- Expense Accounts: Expense accounts are debited during the accounting period to reflect the cost of doing business. They are credited during the closing process to transfer their balance to the Retained Earnings account, which is debited.

- Dividend Accounts: Dividends are distributions of profits to shareholders. These accounts are debited during the period to reflect the distribution of profits. When closing, they are credited, while the Retained Earnings account is debited.

3. The Retained Earnings Account

The Retained Earnings account is the primary permanent account that receives the transferred balances from temporary accounts. It acts as a cumulative record of the company’s profits and losses over its lifetime. This account is a key component of the balance sheet, reflecting the company’s accumulated earnings.

Real-World Examples and Solutions

Example 1: Service Business Closing Entries

Let’s say a small service business, “Handy Helpers,” has the following balances at the end of the period:

| Account | Debit | Credit |

|---|---|---|

| Service Revenue | $0 | $5,000 |

| Salaries Expense | $1,000 | $0 |

| Rent Expense | $500 | $0 |

| Utilities Expense | $200 | $0 |

| Retained Earnings | $1,000 | $0 |

To close these accounts, we will make the following entries:

| Account | Debit | Credit |

|---|---|---|

| Service Revenue | $5,000 | $0 |

| Retained Earnings | $0 | $5,000 |

| (To close Service Revenue) |

| Account | Debit | Credit |

|---|---|---|

| Retained Earnings | $1,700 | $0 |

| Salaries Expense | $0 | $1,000 |

| Rent Expense | $0 | $500 |

| Utilities Expense | $0 | $200 |

| (To close Expense Accounts) |

After these closing entries, the balances will be reflected in the Retained Earnings account, which will now have a balance of $3,300. This figure represents the company’s accumulated net income for the period.

Example 2: Closing Entries for a Merchandising Business

Consider a retail store, “The Trendy Shop,” that sells clothing and accessories. The business has the following balances at the end of the period:

| Account | Debit | Credit |

|---|---|---|

| Sales Revenue | $0 | $10,000 |

| Cost of Goods Sold | $6,000 | $0 |

| Salaries Expense | $2,000 | $0 |

| Rent Expense | $800 | $0 |

| Retained Earnings | $1,000 | $0 |

The closing entries for “The Trendy Shop” are:

| Account | Debit | Credit |

|---|---|---|

| Sales Revenue | $10,000 | $0 |

| Retained Earnings | $0 | $10,000 |

| (To close Sales Revenue) |

| Account | Debit | Credit |

|---|---|---|

| Retained Earnings | $8,800 | $0 |

| Cost of Goods Sold | $0 | $6,000 |

| Salaries Expense | $0 | $2,000 |

| Rent Expense | $0 | $800 |

| (To close Expense Accounts) |

After making these entries, the Retained Earnings account will show a balance of $2,800, reflecting the company’s accumulated net income for the period.

Closing Entries for a Company with Multiple Branches

Closing entries become more complex when a company operates multiple branches. Each branch needs to prepare its own closing entries, and then a summary of these entries is consolidated at the corporate level. This consolidation ensures that the company’s financial statements accurately reflect the performance of all its branches.

For example, imagine a company with three branches: Branch A, Branch B, and Branch C. Each branch has its unique set of revenue and expense accounts. The closing entries for each branch are prepared independently. Once completed, the balances of the temporary accounts for all branches are consolidated into a single set of closing entries at the corporate level. This way, the company’s financial statements will reflect the aggregate performance of all branches.

Best Practices for Creating and Managing Closing Entries

Here are some best practices for creating and managing closing entries that ensure accuracy and efficiency:

- Use a standard format: Adopt a consistent format for closing entries to ensure clarity and prevent errors. Utilize specific account names and descriptions for each entry to avoid confusion.

- Maintain clear documentation: Document each step of the closing process, including the date of the entries, the reason for each entry, and the supporting documentation for each transaction. This documentation helps with auditing and ensures transparency in the accounting process.

- Double-check for accuracy: Double-check all closing entries before posting them to the ledger. Verify debits and credits are equal, and that the correct accounts are used in each entry.

- Utilize accounting software: Utilizing accounting software can automate the closing process, minimizing the risk of errors and saving valuable time. Many accounting software packages have built-in features for closing entries, simplifying the process and improving accuracy.

- Regularly review and update processes: Regularly review and update your closing entry process to adapt to changes in your business operations and accounting standards.

Closing Entries Examples And Solutions Pdf

Closing Entries: A Foundation for Financial Strength

Closing entries are more than just a technical accounting procedure; they are a fundamental aspect of ensuring a company’s financial health and transparency. By understanding the mechanics of closing entries, businesses can ensure that their financial statements accurately reflect their operational performance and position, preparing them for future growth and success. With the right knowledge and processes, closing entries can become an integral part of a robust financial management system.

To delve deeper into closing entries and explore more advanced topics in accounting, consider exploring relevant resources like accounting textbooks, online courses, and professional organizations like the AICPA (American Institute of Certified Public Accountants) and the IMA (Institute of Management Accountants). These resources will provide a comprehensive understanding of accounting principles and practices, enabling you to make sound financial decisions for your business.