The world of accounting can seem daunting, especially when faced with an upcoming exam. Many students struggle to grasp the fundamentals, feeling overwhelmed by the terminology and concepts. But, fear not! This comprehensive guide dives into the must-know accounting principles and provides you with essential insights to conquer your Accounting 101 exam. We’ll explore key concepts, provide practice questions and answers, and even offer tips for excelling in your studies!

Image: www.studocu.com

Remember that crucial first accounting class? It seemed like a whole new language with debits and credits, financial statements, and the elusive balance sheet. The pressure to understand and retain everything felt immense. But, what if you had a resource to guide you through those initial steps? That’s where this guide comes in! We’ll break down complex ideas into digestible chunks, making your Accounting 101 journey smoother than ever before.

Understanding the Basics: Accounting 101 Explained

Accounting is essentially the language of business. It’s the system used to record, classify, summarize, and analyze financial transactions. This information is then used by various stakeholders, including investors, creditors, and management, to make informed decisions. Understanding how businesses manage their money, track their performance, and report their financial health is crucial, both for those within the business and those interacting with it.

The first step into the world of accounting often involves navigating the fundamental concepts like assets, liabilities, and equity. These form the foundation of balance sheets, which provide a snapshot of the company’s financial position at a specific point in time. Then there are income statements, which detail the company’s revenue and expenses over a period, summarizing profitability. Combining these pieces forms a financial picture of the business’s performance.

Accounting 101 typically covers a plethora of topics, including:

- Financial Accounting: This focuses on external reporting, using generally accepted accounting principles (GAAP) to prepare statements for investors and stakeholders.

- Managerial Accounting: This branch focuses on internal use, providing information that helps managers make better business decisions.

- Basic Accounting Concepts: This includes understanding the accounting equation (Assets = Liabilities + Equity), the double-entry bookkeeping system, and the flow of financial information.

- Financial Statements: You’ll learn to analyze balance sheets, income statements, and statements of cash flows to understand a company’s financial health.

- Cost Accounting: This involves techniques for tracking and controlling production costs and other business expenses.

Mastering Accounting 101: Practice Questions and Answers

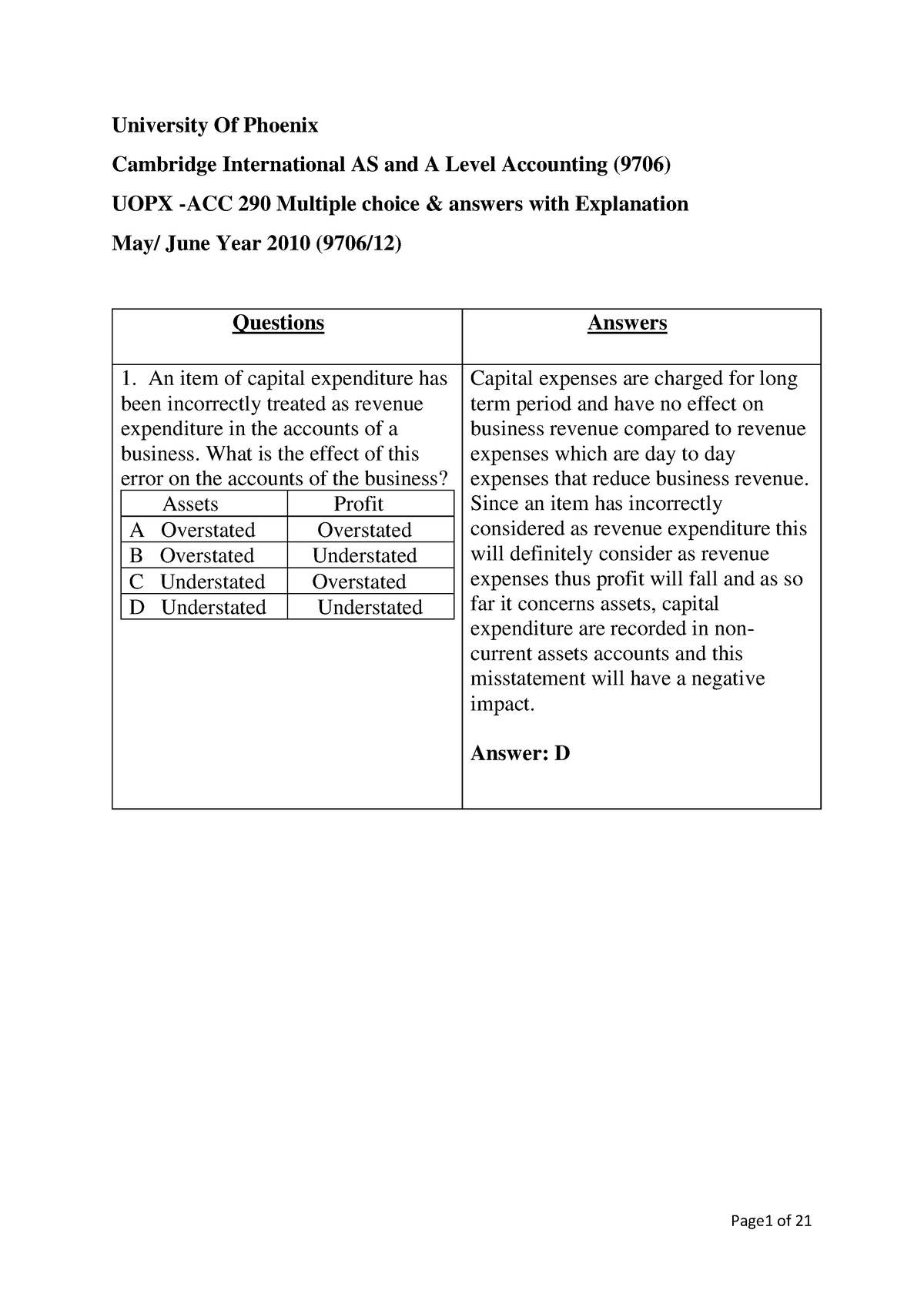

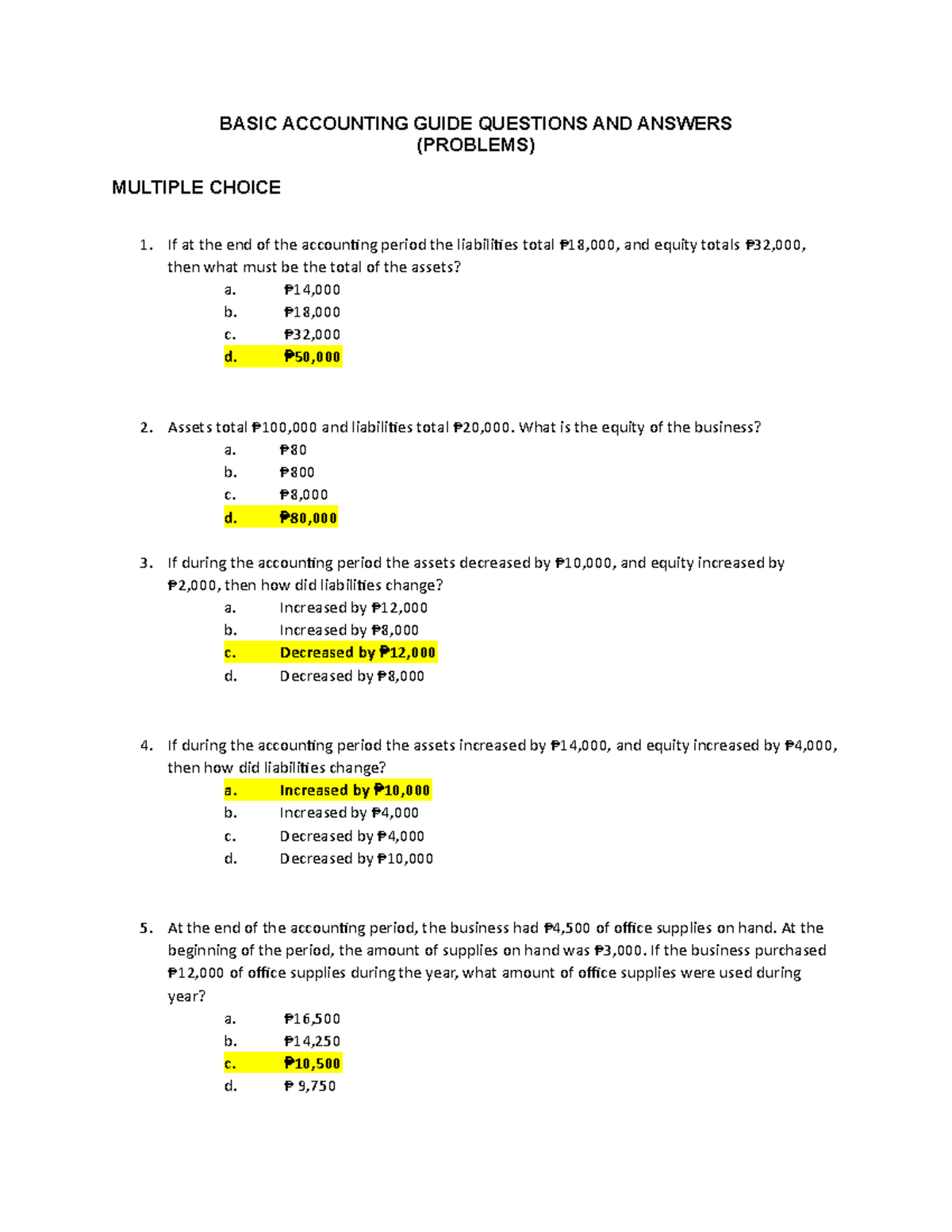

The best way to solidify your understanding of accounting principles is through practice. Many online resources provide practice questions and answers, allowing you to test your knowledge and pinpoint areas where you need further review. Here is a sample of the types of questions you might encounter in an Accounting 101 exam:

Practice Question 1:

What is the accounting equation?

Answer: Assets = Liabilities + Equity

Image: www.studocu.com

Practice Question 2:

Which of the following is an asset?

- a) Loan Payable

- b) Accounts Payable

- c) Cash

- d) Owner’s Equity

Answer: c) Cash

Practice Question 3:

What is the purpose of the income statement?

Answer: The income statement (often called the profit and loss statement) reports a company’s revenues and expenses over a specific period. It determines whether the company has made a profit or suffered a loss.

Practice Question 4:

A company purchases a piece of equipment for $10,000. How would this transaction be recorded in the accounting system?

Answer: This transaction would be recorded as a debit to Equipment (an asset) and a credit to Cash (an asset) by the same amount, $10,000, in order to maintain the accounting equation balance.

Practice Question 5:

What is the difference between accrual and cash basis accounting?

Answer: Cash-basis accounting records transactions when cash is actually received or paid out. Accrual accounting records revenue when it is earned and expenses when they are incurred, regardless of when the cash is received or paid.

Exam Success Strategies: Tips from an Accounting Expert

Beyond just understanding concepts, preparing for an exam involves effective study techniques. Here are a few tips to help you excel in your Accounting 101 exam:

- Active Reading: Don’t just passively read your textbook; actively engage with the material. Highlight key concepts, write summaries, and create your own flashcards to test your knowledge.

- Practice, Practice, Practice: The more you practice, the more familiar you become with the concepts and types of questions you might encounter. Make use of online quizzes, sample exams, and study guides.

- Seek Help When Needed: Don’t hesitate to ask your professor or teaching assistant for clarification on any complex topics. You can also join a study group with fellow students to discuss and reinforce your understanding.

- Manage Your Time Effectively: Creating a study schedule and sticking to it is crucial. Allocate enough time for each subject, and don’t cram the night before the exam.

- Master Key Concepts: Focus on understanding the foundational principles, such as the accounting equation, double-entry bookkeeping, and the different types of financial statements. Once you have a solid grasp of these basics, the rest of the concepts become easier to grasp.

- Don’t Forget the Terminology: Accounting has its own specialized language. Make a list of important terms and their definitions, and review them regularly.

- Stay Calm and Confident: Remember that you have prepared diligently. Trust in your abilities and approach the exam with a clear mind and a positive attitude.

These tips go beyond just memorizing formulas and definitions. They emphasize active learning, building a strong foundation, and approaching the exam with confidence. Remember, practice and a solid understanding of the core concepts are key to achieving success in your Accounting 101 exam!

Frequently Asked Questions (FAQ)

Here are some common questions students have about Accounting 101:

Q: What are some common accounting software programs?

A: Several accounting software programs are available, including QuickBooks, Xero, and Sage. These can cater to both small businesses and larger corporations, streamlining accounting tasks.

Q: Is it necessary to take a specific accounting course before moving on to other business courses?

A: In many business programs, Accounting 101 is a foundational course that provides a basic understanding of financial concepts. It often acts as a prerequisite for other business courses.

Q: What career paths are open to students with a strong understanding of accounting?

A: Accounting skills are highly sought-after. Students with a good grasp of accounting can pursue careers as accountants, auditors, financial analysts, tax preparers, and financial managers, among other roles.

Q: What are some of the latest trends in the accounting profession?

A: The accounting profession is evolving, with technology playing a larger role. Artificial intelligence (AI), cloud-based software, and data analytics are becoming increasingly important. There’s a growing demand for accountants with digital skills, enabling them to handle large datasets and automate routine tasks. The emergence of fintech companies is also impacting the landscape, bringing new financial products and services to the market.

Accounting 101 Exam Questions And Answers Pdf

Conclusion:

This guide has covered essential concepts, practical tips, and frequently asked questions about Accounting 101, from understanding the basic accounting equation to mastering financial statements and discovering the latest trends in the field. Are you ready to tackle your next Accounting 101 exam with confidence? Remember, practice is key, and a thorough understanding of the concepts will pave the way for success.