Have you ever stared at a balance sheet, a jumble of numbers and unfamiliar terms, and felt like you were looking at a foreign language? Accounting, especially at the 11.6 level, often throws complex scenarios and calculations that can feel overwhelming. But fear not! This article delves into the intricacies of Accounting 11.6 mastery problems, providing you with the keys to confidently navigate the world of financial statements.

Image: sciencebrief10.gitlab.io

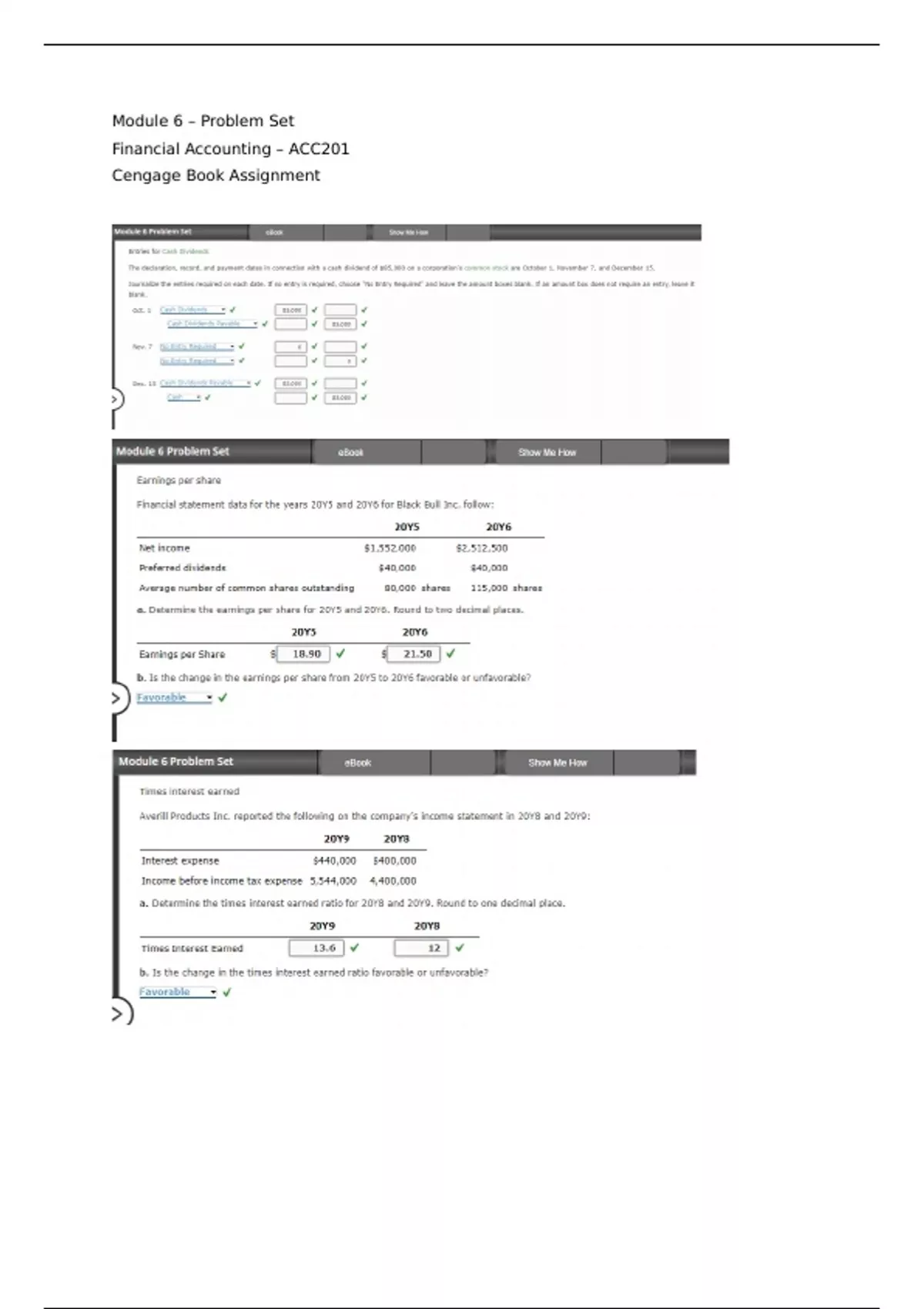

Understanding Accounting 11.6 is crucial for students pursuing business or finance-related careers. These mastery problems serve as a bridge between theoretical knowledge and practical application. They introduce various accounting concepts, such as financial ratios, cash flow analysis, and inventory valuation, and test your ability to analyze and interpret financial data. Mastering these problems can not only boost your grades but also prepare you for the challenges you’ll face in the real world.

Mastering the Fundamentals: Key Concepts for Accounting 11.6

Before tackling the intricate mastery problems, it’s essential to grasp the fundamental concepts that underpin Accounting 11.6. Here’s a breakdown of crucial topics you’ll need to understand:

1. Financial Statements

Understanding the four primary financial statements is the cornerstone of accounting. Each statement offers a unique lens into a company’s financial health:

- Balance Sheet: A snapshot of a company’s assets, liabilities, and equity at a specific point in time. It highlights the company’s financial position.

- Income Statement: A report on a company’s revenues, expenses, and resulting net income or loss over a specific period. It reveals the company’s profitability.

- Statement of Cash Flows: Tracks all cash inflows and outflows during a period. It provides insight into a company’s cash management and liquidity.

- Statement of Changes in Shareholders’ Equity: Details the changes in shareholder equity, including profits, losses, and dividends.

2. Financial Ratios

Financial ratios are powerful tools for analyzing a company’s performance. They help you compare a company’s financial position to industry benchmarks and identify areas for improvement:

- Liquidity Ratios: Measure a company’s ability to meet short-term financial obligations.

- Solvency Ratios: Assess a company’s ability to meet long-term debt obligations.

- Profitability Ratios: Gauge a company’s ability to generate profits.

- Activity Ratios: Analyze how efficiently a company uses its assets.

Image: www.stuvia.com

3. Inventory Valuation

Accurately valuing inventory is crucial for determining a company’s profitability. Several methods are used for inventory valuation, each affecting the cost of goods sold and net income:

- First-In, First-Out (FIFO): Assumes that the oldest inventory is sold first, leading to a higher net income during periods of inflation.

- Last-In, First-Out (LIFO): Assumes that the newest inventory is sold first, resulting in a lower net income during periods of inflation.

- Weighted-Average: Calculates a weighted average cost for all inventory and applies this average cost to each unit sold.

4. Cash Flow Analysis

Cash flow analysis is essential for understanding a company’s ability to generate cash and meet its financial obligations. It involves analyzing cash flows from:

- Operating Activities: Cash generated or used by a company’s core operations.

- Investing Activities: Cash flows related to the purchase or sale of long-term assets.

- Financing Activities: Cash flows related to borrowing, repaying debt, or issuing stock.

Tackling Accounting 11.6 Mastery Problems: A Step-by-Step Guide

Now that you’ve refreshed your understanding of the key concepts, let’s embark on a guided journey through typical Accounting 11.6 mastery problems. Remember, practice is key to mastery. The more you engage with these problems, the more comfortable you’ll become with the concepts.

1. Analyze the Balance Sheet

Mastery problems often involve analyzing a company’s balance sheet to determine key financial indicators. For example, you might be asked to calculate the current ratio or the debt-to-equity ratio. These ratios shed light on a company’s liquidity and financial leverage. Don’t forget to consult the company’s financial statements, including notes, for valuable context.

2. Calculate Income Statement Items

Income statement problems can involve calculating gross profit, operating expenses, or net income. You might also be asked to analyze the impact of specific transactions on the income statement. Consider using T-accounts to track the flow of revenues and expenses.

3. Prepare a Statement of Cash Flows

Statement of cash flow problems require you to classify various activities into their respective categories: operating, investing, and financing. You’ll need to analyze transactions and determine their impact on cash flows. Pay close attention to the timing of cash receipts and disbursements.

4. Analyze Inventory Valuation

Inventory valuation problems often require you to calculate the cost of goods sold (COGS) and ending inventory using different methods. You might be faced with scenarios involving purchases, sales, and returns. Remember that the inventory valuation method chosen can significantly impact the COGS and net income.

5. Reconciling Financial Statements

Some mastery problems involve reconciling different financial statements. For instance, you might need to reconcile the net income from the income statement with the cash flow from operating activities in the statement of cash flows. This reconciliation is crucial for understanding the difference between accrual-based accounting and cash-basis accounting.

Tips for Mastering the 11.6 Challenges

Here are some tips to help you conquer those Accounting 11.6 mastery problems:

- Practice Regularly: Like any skill, accounting takes practice. Solve as many problems as possible to enhance your understanding and build confidence.

- Understand the Concepts: Don’t simply memorize formulas. Focus on understanding the underlying concepts and how they relate to the real world.

- Utilize Resources: Take advantage of textbooks, online resources, and your professor’s office hours. Seek clarification on any areas you’re struggling with.

- Apply Critical Thinking: Accounting problems often involve complex scenarios. Don’t be afraid to think critically and apply your knowledge to solve them.

- Learn from Mistakes: Don’t be discouraged by mistakes. Analyze your errors to identify areas where you need improvement and move forward with a fresh perspective.

Accounting 11 6 Mastery Problem Answers

The Importance of Mastery in Accounting

Mastering Accounting 11.6 isn’t just about getting good grades. It equips you with the skills to navigate the financial world, whether you’re pursuing a career in accounting, finance, or any other business discipline. You’ll gain the ability to analyze financial statements, understand financial ratios, and make informed financial decisions. This knowledge will become invaluable for your future endeavors, giving you a competitive edge in the professional world.

As you journey through Accounting 11.6, remember that the key to mastery is understanding the concepts, applying them to real-world scenarios, and practicing consistently.