Imagine this: you’re trying to send money to a friend in another state. You head to your bank, ready to make the transfer. But then, the teller asks for a routing number. You’ve heard the term before, but you’re not entirely sure what it is or why it’s needed. If this sounds familiar, you’re not alone. Many people have questions about routing numbers, especially those associated with the Federal Reserve Banks.

Image: www.depositaccounts.com

Routing numbers are a crucial part of the financial system, ensuring that money moves smoothly and securely between banks. This article will delve into the world of Federal Reserve Banks and their associated routing numbers, explaining everything you need to know. We’ll cover how the system works, what makes Federal Reserve Banks unique, and offer tips for finding the information you need.

The Federal Reserve System and Routing Numbers

The Federal Reserve System, often referred to as “the Fed,” is the central banking system of the United States. Created in 1913, it plays a vital role in maintaining the stability of the U.S. financial system by regulating banks, setting interest rates, and managing the money supply.

One of the Fed’s key functions is facilitating the transfer of funds between banks. To do this, they established a network of 12 regional Federal Reserve Banks throughout the country, each with its own unique nine-digit routing number. This network is crucial to the smooth flow of money throughout the U.S. financial ecosystem.

Understanding Federal Reserve Bank Routing Numbers

Federal Reserve Bank routing numbers are unique identifiers that represent each of the 12 regional Federal Reserve Banks, which are located in:

- Boston

- New York

- Philadelphia

- Cleveland

- Richmond

- Atlanta

- Chicago

- St. Louis

- Minneapolis

- Kansas City

- Dallas

- San Francisco

Each of these banks has a specific purpose within the system and acts as a central hub for financial institutions within their respective regions. These routing numbers are used by banks and financial institutions for various purposes, such as:

- Wire transfers: When you send money via a wire transfer, the routing number tells the sending bank where to send the funds.

- ACH (Automated Clearing House) transactions: These are electronic payments that are processed through a network of banks, and the routing number helps to direct these payments.

- Check processing: When you deposit a check, the routing number tells the bank where to process the check.

Finding the Right Routing Number

You might wonder how you can find the correct routing number for a specific bank. Thankfully, several resources are available. Here’s a breakdown:

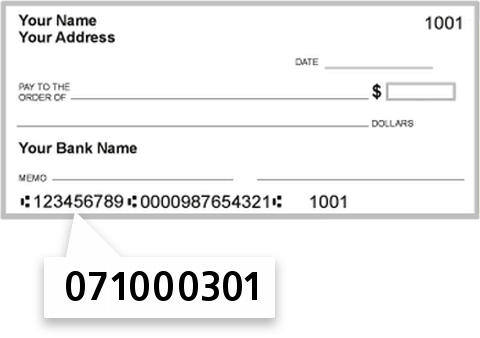

Image: bank-routing.org

1. Check Your Bank Statements or Online Banking

The easiest way to find your routing number is to look at your bank statements. It’s typically printed on the bottom or top of your statements, often near your account number.

Many online banking platforms also include this information. Just navigate to the account details or settings section to find your routing number.

2. Contact Your Bank Directly

If you can’t find your routing number on your statements or online, call your bank’s customer service department. They can provide the routing number over the phone.

3. Use a Routing Number Lookup Tool

Several websites offer free routing number lookup tools. Simply enter your bank’s name or account information, and the tool will display the corresponding routing number.

Additional Tips and Expert Advice

When using routing numbers, it’s crucial to be careful and accurate. Here are a few tips:

- Double-check the numbers: Even a single wrong digit can cause delays or prevent your payment from going through.

- Be cautious with unofficial sources: Only use reputable sources like your bank’s website, statements, or trusted lookup tools.

- Understand the difference between your routing number and account number: These are distinct numbers, and both are essential for processing transactions correctly.

Frequently Asked Questions

What is the difference between a routing number and an account number?

A routing number identifies the bank or financial institution. An account number identifies a specific account within that institution. Think of it this way: the routing number is like the address of the bank, while the account number is your specific apartment or suite within that address.

Can I use a Federal Reserve Bank routing number for my personal transactions?

No, you shouldn’t use a Federal Reserve Bank routing number for personal transactions. These numbers are used by banks and financial institutions for internal transactions. You should use your own bank’s routing number for personal payments.

Why are there 12 Federal Reserve Banks?

The United States is divided into 12 Federal Reserve Districts, each with its own Federal Reserve Bank. This structure was designed to ensure that the Fed’s policies reflected the diverse needs of different regions of the country.

List Of Federal Reserve Banks Routing Numbers

Conclusion

Understanding Federal Reserve Bank routing numbers is essential for anyone engaging in financial transactions. It’s a cornerstone of the U.S.’s financial system, ensuring smooth and efficient money transfer between banks. The information we’ve covered provides a comprehensive understanding of this critical aspect of the financial world. Whether you’re a business owner, an individual making a payment, or simply curious about the inner workings of banking, having this knowledge can be valuable.

Are you interested in learning more about Federal Reserve Banks and the financial system they support? Share your thoughts and questions in the comments below!