The world of accounting is built on trust. When clients hand over their financial records, they expect accuracy, transparency, and integrity. But what happens when that trust is violated? Imagine a scenario where a friend asks for your help with their taxes, and you find yourself tempted to inflate deductions for their benefit. Would you know what the right course of action is? This is where the AICPA Code of Professional Conduct comes in. It serves as the bedrock of ethical behavior for CPAs, providing a framework for navigating complex scenarios and upholding the highest professional standards.

Image: www.chegg.com

This article delves into the AICPA Code of Professional Conduct PDF, explaining its significance, key principles, and practical implications for CPAs and anyone involved in financial matters. Whether you’re a seasoned accountant or just beginning your journey in the world of finance, understanding the principles outlined in this document is essential for maintaining integrity and safeguarding your professional reputation.

Understanding the AICPA Code of Professional Conduct: A Comprehensive Guide

The AICPA Code of Professional Conduct is a comprehensive set of ethical guidelines designed to govern the behavior of Certified Public Accountants (CPAs) in the United States. This document, readily available in PDF format, sets forth the fundamental principles of professional conduct for CPAs, ensuring that they act with honesty, integrity, and objectivity in their professional lives.

The AICPA Code is a living document, constantly evolving to meet the changing demands of the accounting profession and the broader business landscape. Its history dates back to the early 20th century, and it has been repeatedly updated to address emerging ethical challenges and technological advancements. Its purpose is to maintain public confidence in the accounting profession, safeguarding its reputation and ensuring that professionals abide by the highest ethical standards.

Key Principles of the AICPA Code of Professional Conduct

The AICPA Code of Professional Conduct is built upon six core principles that guide CPAs’ actions and decision-making. These principles serve as the foundation for ethical conduct in the accounting profession:

- Responsibilities: CPAs are obligated to act in a manner that is consistent with the public interest. They must hold themselves to the highest ethical standards and be responsible for their actions and decisions.

- Public Interest: The AICPA Code emphasizes the importance of CPAs serving the public interest. This requires that their actions and decisions benefit the public at large, not just their personal interests or those of their clients.

- Integrity: This principle requires CPAs to be honest and straightforward in all their dealings. They must avoid any actions or omissions that could mislead others or compromise their integrity. They are to be truthful and candid in their dealings with clients, colleagues, and the public.

- Objectivity: Objectivity demands that CPAs remain impartial and unbiased in their professional judgments. They must avoid conflicts of interest and ensure their professional decisions are not influenced by personal biases or external pressures.

- Due Professional Care: CPAs are expected to perform their professional services with the diligence and skill that are reasonably expected of a professional. This includes staying up-to-date on relevant industry knowledge, adhering to professional standards, and exercising due care in their work.

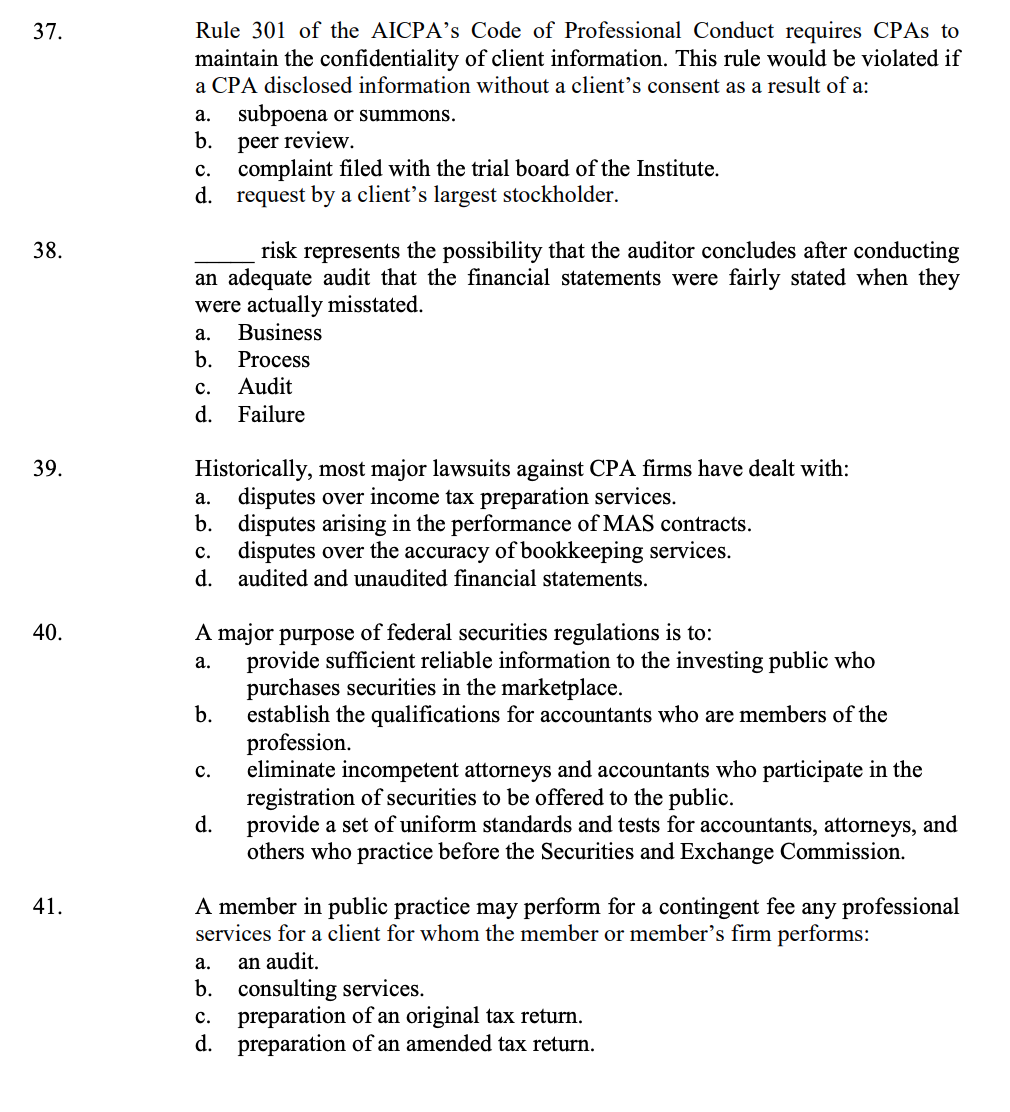

- Confidentiality: CPAs have a duty to maintain confidentiality of client information obtained during their professional activities. This obligation extends to all sensitive matters, and breaches of confidentiality can have serious consequences, both professionally and legally.

Rules of Conduct

Building upon these fundamental principles, the AICPA Code of Professional Conduct outlines a set of rules that establish specific ethical requirements for CPAs. These rules address a wide range of professional activities, covering areas such as:

- Independence: CPAs must maintain independence in their audit and advisory services. This rule prohibits relationships or activities that could impair objectivity and threaten the public’s confidence in their professional work.

- Integrity and Objectivity: This rule covers ethical behavior in accounting and financial reporting activities. CPAs are expected to uphold the integrity of the accounting process and avoid any actions that could compromise the accuracy or reliability of financial information.

- General Standards: This section establishes general principles for CPAs, such as the requirement to perform their professional services with due professional care and to comply with applicable professional standards.

- Accounting Principles: These rules ensure that CPAs comply with generally accepted accounting principles (GAAP) when preparing financial statements. GAAP provides a consistent framework for accounting and reporting, promoting transparency and comparability across businesses.

- Confidential Client Information: This set of rules addresses the importance of protecting client confidentiality. CPAs are obligated to keep client information confidential, except in certain limited circumstances where disclosure is required or permitted by law.

- Acts Discredible: This rule covers a range of activities that could bring discredit to the accounting profession or violate the public trust. It prohibits CPAs from engaging in any acts that would reflect poorly on their professional reputation or integrity.

Image: www.coursehero.com

Application and Enforcement

The AICPA Code of Professional Conduct is not merely a theoretical document. It has real-world consequences for CPAs and those who interact with them. The AICPA, through its Professional Ethics Division, is responsible for enforcing the Code. The AICPA investigates complaints of ethical misconduct and may take disciplinary action against CPAs who violate the Code.

Even when a CPA’s actions don’t directly violate the Code, they could still be subject to scrutiny and sanctions if their actions undermine the public’s trust in the accounting profession or if they fail to meet the expected standards of conduct.

The Latest Trends and Developments in the AICPA Code of Professional Conduct

The AICPA Code of Professional Conduct is a dynamic document that reflects the evolving landscape of the accounting profession and the broader business world. The AICPA is continually updating the Code to address new ethical challenges and technological advancements. These updates are often triggered by changes in regulatory frameworks, accounting standards, and societal values. The AICPA also closely monitors industry trends and emerging risks to identify areas where the Code may need to be strengthened or clarified.

Key Updates and Developments

- Increased Focus on Cybersecurity: In recent years, there has been a surge in cybersecurity threats, and the AICPA has responded by updating the Code to address the unique ethical challenges posed by these threats. The Code now includes specific guidance on CPAs’ responsibilities related to cybersecurity and data privacy.

- Emphasis on Technology and Artificial Intelligence: As technology and artificial intelligence (AI) continue to transform the accounting profession, the AICPA is updating the Code to ensure that it remains relevant in this rapidly evolving landscape. The Code now includes guidance on the ethical use of technology in accounting and auditing, addressing issues such as automation, data analytics, and algorithmic bias.

- Enhanced Guidance on Independence: The AICPA has re-emphasized the importance of independence in the Code, specifically for those CPAs providing audit and advisory services. The Code now provides even clearer guidance on identifying and managing conflicts of interest, ensuring that CPAs maintain objectivity and integrity in their work.

- Greater Transparency and Communication: The AICPA is promoting greater transparency and communication regarding the Code of Professional Conduct. It has developed resources and tools to assist CPAs in understanding and applying the Code, including online training programs, ethics case studies, and interactive forums.

Tips and Expert Advice for Applying the AICPA Code of Professional Conduct

Navigating the AICPA Code of Professional Conduct can sometimes be overwhelming, especially for newer CPAs. Here are some tips to help you apply the Code’s principles and rules effectively in your professional life:

- Know the code: Your first step is to understand the Code thoroughly. Read it, review the key principles, and familiarize yourself with its provisions. Attend AICPA ethics training programs and workshops, leveraging these resources to enhance your understanding.

- Recognize ethical dilemmas: Be prepared to identify situations that raise ethical concerns. Think critically about potential conflicts of interest, biases, or pressures that could compromise your integrity.

- Seek guidance: If you encounter an ethical dilemma, don’t hesitate to reach out for advice. Talk to senior colleagues, mentors, or the AICPA Ethics Hotline for guidance and support.

- Document your actions: Keep a record of your decisions and communications related to ethical matters. Good documentation can be crucial if you find yourself facing a complaint or an investigation later.

Remember, the AICPA Code of Professional Conduct is not just a set of rules; it’s a framework for making ethical decisions in a challenging and complex world. The principles and rules outlined in the Code should guide your professional behavior in every situation, ensuring that you act with integrity and uphold the highest standards of trust and professionalism.

Frequently Asked Questions (FAQs) about the AICPA Code of Professional Conduct:

Q: What is the purpose of the AICPA Code of Professional Conduct?

A: The AICPA Code of Professional Conduct sets forth ethical standards for CPAs, ensuring they act with integrity, objectivity, and in the best interests of the public. Its purpose is to maintain public confidence in the accounting profession.

Q: How often is the AICPA Code of Professional Conduct updated?

A: The AICPA Code of Professional Conduct is regularly updated to reflect changes in the accounting profession and the broader business environment. Updates can range from minor clarifications to significant revisions.

Q: What happens if a CPA violates the AICPA Code of Professional Conduct?

A: The AICPA can impose disciplinary action, ranging from reprimands to expulsion, for violations of the Code. In addition, violations may lead to legal action from clients, regulatory agencies, or other parties.

Q: Is the AICPA Code of Professional Conduct legally binding?

A: While the AICPA Code of Professional Conduct is not a law, it can influence legal proceedings and may serve as evidence of a CPA’s negligence or ethical breaches. Additionally, state boards of accountancy may adopt their own rules of professional conduct, drawing from the AICPA Code.

Q: Can I access the AICPA Code of Professional Conduct online?

A: Yes, the AICPA Code of Professional Conduct is available as a free PDF download on the AICPA website.

Aicpa Code Of Professional Conduct Pdf

Conclusion

The AICPA Code of Professional Conduct is an essential document for anyone involved in accounting or financial matters. It provides a clear framework for ethical behavior, ensuring that CPAs act with honesty, integrity, and objectivity. By adhering to the principles and rules outlined in the Code, CPAs contribute to maintaining the public trust and upholding the highest professional standards.

Are you interested in learning more about the AICPA Code of Professional Conduct or how it applies to your specific field? Let us know! We can explore its intricacies further and discuss its practical implications.